#Once you have a home equity line of credit

Explore tagged Tumblr posts

Text

Wall Street Journal goes to bat for the vultures who want to steal your house

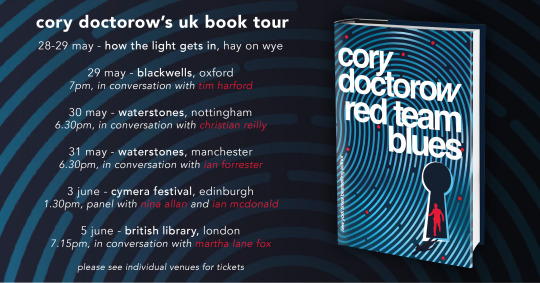

Tonight (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Tomorrow (June 6), I’m on a Rightscon panel about interoperability.

The tacit social contract between the Wall Street Journal and its readers is this: the editorial page is for ideology, and the news section is for reality. Money talks and bullshit walks — and reality’s well-known anticapitalist bias means that hewing too closely to ideology will make you broke, and thus unable to push your ideology.

That’s why the editorial page will rail against “printing money” while the news section will confine itself to asking which kinds of federal spending competes with the private sector (creating a bidding war that drives up prices) and which kinds are not. If you want frothing takes about how covid relief checks will create “debt for our grandchildren,” seek it on the editorial page. For sober recognition that giving small amounts of money to working people will simply go to reducing consumer and student debt, look to the news.

But WSJ reporters haven’t had their corpus colossi severed: the brain-lobe that understands economic reality crosstalks with the lobe that worship the idea of a class hierarchy with capital on top and workers tugging their forelacks. When that happens, the coverage gets weird.

Take this weekend’s massive feature on “zombie mortgages,” long-written-off second mortgages that have been bought by pennies for vultures who are now trying to call them in:

https://www.wsj.com/articles/zombie-mortgages-could-force-some-homeowners-into-foreclosure-e615ab2a

These second mortgages — often in the form of home equity lines of credit (HELOCs) — date back to the subprime bubble of the early 2000s. As housing prices spiked to obscene levels and banks figured out how to issue risky mortgages and sell them off to suckers, everyday people were encouraged — and often tricked — into borrowing heavily against their houses, on complicated terms that could see their payments skyrocket down the road.

Once the bubble popped in 2008, the value of these houses crashed, and the mortgages fell “underwater” — meaning that market value of the homes was less than the amount outstanding on the mortgage. This triggered the foreclosure crisis, where banks that had received billions in public money forced their borrowers out of their homes. This was official policy: Obama’s Treasury Secretary Timothy Geithner boasted that forcing Americans out of their homes would “foam the runways” for the banks and give them a soft landing;

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

With so many homes underwater on their first mortgages, the holders of those second mortgages wrote them off. They had bought high-risk, high reward debt, the kind whose claims come after the other creditors have been paid off. As prices collapsed, it became clear that there wouldn’t be anything left over after those higher-priority loans were paid off.

The lenders (or the bag-holders the lenders sold the loans to) gave up. They stopped sending borrowers notices, stopped trying to collect. That’s the way markets work, after all — win some, lose some.

But then something funny happened: private equity firms, flush with cash from an increasingly wealthy caste of one percenters, went on a buying spree, snapping up every home they could lay hands on, becoming America’s foremost slumlords, presiding over an inventory of badly maintained homes whose tenants are drowned in junk fees before being evicted:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

This drove a new real estate bubble, as PE companies engaged in bidding wars, confident that they could recoup high one-time payments by charging working people half their incomes in rent on homes they rented by the room. The “recovery” of real estate property brought those second mortgages back from the dead, creating the “zombie mortgages” the WSJ writes about.

These zombie mortgages were then sold at pennies on the dollar to vulture capitalists — finance firms who make a bet that they can convince the debtors to cough up on these old debts. This “distressed debt investing” is a scam that will be familiar to anyone who spends any time watching “finance influencers” — like forex trading and real estate flipping, it’s a favorite get-rich-quick scheme peddled to desperate people seeking “passive income.”

Like all get-rich-quick schemes, distressed debt investing is too good to be true. These ancient debts are generally past the statute of limitations and have been zeroed out by law. Even “good” debts generally lack any kind of paper-trail, having been traded from one aspiring arm-breaker to another so many times that the receipts are long gone.

Ultimately, distressed debt “investing” is a form of fraud, in which the “investor” has to master a social engineering patter in which they convince the putative debtor to pay debts they don’t actually owe, either by shading the truth or lying outright, generally salted with threats of civil and criminal penalties for a failure to pay.

That certainly goes for zombie mortgages. Writing about the WSJ’s coverage on Naked Capitalism, Yves Smith reminds readers not to “pay these extortionists a dime” without consulting a lawyer or a nonprofit debt counsellor, because any payment “vitiates” (revives) an otherwise dead loan:

https://www.nakedcapitalism.com/2023/06/wall-street-journal-aids-vulture-investors-threatening-second-mortgage-borrowers-with-foreclosure-on-nearly-always-legally-unenforceable-debt.html

But the WSJ’s 35-paragraph story somehow finds little room to advise readers on how to handle these shakedowns. Instead, it lionizes the arm-breakers who are chasing these debts as “investors…[who] make mortgage lending work.” The Journal even repeats — without commentary — the that these so-called investors’ “goal is to positively impact homeowners’ lives by helping them resolve past debt.”

This is where the Journal’s ideology bleeds off the editorial page into the news section. There is no credible theory that says that mortgage markets are improved by safeguarding the rights of vulture capitalists who buy old, forgotten second mortgages off reckless lenders who wrote them off a decade ago.

Doubtless there’s some version of the Hayek Mind-Virus that says that upholding the claims of lenders — even after those claims have been forgotten, revived and sold off — will give “capital allocators” the “confidence” they need to make loans in the future, which will improve the ability of everyday people to afford to buy houses, incentivizing developers to build houses, etc, etc.

But this is an ideological fairy-tale. As Michael Hudson describes in his brilliant histories of jubilee — debt cancellation — through history, societies that unfailingly prioritize the claims of lenders over borrowers eventually collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Foundationally, debts are amassed by producers who need to borrow capital to make the things that we all need. A farmer needs to borrow for seed and equipment and labor in order to sow and reap the harvest. If the harvest comes in, the farmer pays their debts. But not every harvest comes in — blight, storms, war or sickness — will eventually cause a failure and a default.

In those bad years, farmers don’t pay their debts, and then they add to them, borrowing for the next year. Even if that year’s harvest is good, some debt remains. Gradually, over time, farmers catch enough bad beats that they end up hopelessly mired in debt — debt that is passed on to their kids, just as the right to collect the debts are passed on to the lenders’ kids.

Left on its own, this splits society into hereditary creditors who get to dictate the conduct of hereditary debtors. Run things this way long enough and every farmer finds themselves obliged to grow ornamental flowers and dainties for their creditors’ dinner tables, while everyone else goes hungry — and society collapses.

The answer is jubilee: periodically zeroing out creditors’ claims by wiping all debts away. Jubilees were declared when a new king took the throne, or at set intervals, or whenever things got too lopsided. The point of capital allocation is efficiency and thus shared prosperity, not enriching capital allocators. That enrichment is merely an incentive, not the goal.

For generations, American policy has been to make housing asset appreciation the primary means by which families amass and pass on wealth; this is in contrast to, say, labor rights, which produce wealth by rewarding work with more pay and benefits. The American vision is that workers don’t need rights as workers, they need rights as owners — of homes, which will always increase in value.

There’s an obvious flaw in this logic: houses are necessities, as well as assets. You need a place to live in order to raise a family, do a job, found a business, get an education, recover from sickness or live out your retirement. Making houses monotonically more expensive benefits the people who get in early, but everyone else ends up crushed when their human necessity is treated as an asset:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Worse: without a strong labor sector to provide countervailing force for capital, US politics has become increasingly friendly to rent-seekers of all kinds, who have increased the cost of health-care, education, and long-term care to eye-watering heights, forcing workers to remortgage, or sell off, the homes that were meant to be the source of their family’s long-term prosperity:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

Today, reality’s leftist bias is getting harder and harder to ignore. The idea that people who buy debt at pennies on the dollar should be cheered on as they drain the bank-accounts — or seize the homes — of people who do productive work is pure ideology, the kind of thing you’d expect to see on the WSJ’s editorial page, but which sticks out like a sore thumb in the news pages.

Thankfully, the Consumer Finance Protection Bureau is on the case. Director Rohit Chopra has warned the arm-breakers chasing payments on zombie mortgages that it’s illegal for them to “threaten judicial actions, such as foreclosures, for debts that are past a state’s statute of limitations.”

But there’s still plenty of room for more action. As Smith notes, the 2012 National Mortgage Settlement — a “get out of jail for almost free” card for the big banks — enticed lots of banks to discharge those second mortgages. Per Smith: “if any servicer sold a second mortgage to a vulture lender that it had charged off and used for credit in the National Mortgage Settlement, it defrauded the Feds and applicable state.”

Maybe some hungry state attorney general could go after the banks pulling these fast ones and hit them for millions in fines — and then use the money to build public housing.

Catch me on tour with Red Team Blues in London and Berlin!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/04/vulture-capitalism/#distressed-assets

[Image ID: A Georgian eviction scene in which a bobby oversees three thugs who are using a battering ram to knock down a rural cottage wall. The image has been crudely colorized. A vulture looks on from the right, wearing a top-hat. The battering ram bears the WSJ logo.]

#pluralistic#great financial crisis#vulture capitalism#debts that can’t be paid won’t be paid#zombie debts#jubilee#michael hudson#wall street journal#business press#house thieves#debt#statute of limitations

129 notes

·

View notes

Text

Mortigage Loan

Can We Top Up a Mortgage Loan?

A mortgage loan is often one of the largest financial commitments in a person’s life. However, as financial needs evolve, you might wonder whether it’s possible to access additional funds on top of your existing mortgage. The good news is that many lenders offer a “top-up” option for mortgage loans, allowing borrowers to secure extra funds without taking out a completely new loan. This guide will help you understand what a top-up mortgage loan is, how it works, and whether it’s the right choice for you.

If you’re seeking reliable information about mortgage top-ups, Loanz360 is your go-to platform for expert advice and resources tailored to your needs.

What Is a Mortgage Top-Up?

For instance, if your home is valued at $500,000 and you still owe $300,000 on your mortgage, you have $200,000 in equity. Most lenders allow you to borrow up to a certain percentage of your property’s value (e.g., 80%), which means you could potentially top up your mortgage by $100,000.

For more insights on leveraging your home’s equity effectively, visit Loanz360 today.

Benefits of a Mortgage Top-Up

Convenience: Since it’s added to your existing mortgage, you avoid the hassle of managing multiple loan accounts.

Lower Interest Rates: Using a top-up option can be a cost-effective way to finance large expenses.

Flexible Usage:Home renovationsEducation expensesMedical emergenciesDebt consolidation

Potential Tax Benefits: In some cases, you may be eligible for tax benefits on the interest paid for a top-up loan if the funds are used for specific purposes, such as home improvement or business investment.

Eligibility Criteria for a Mortgage Top-Up

To qualify for a top-up loan, you must meet certain eligibility requirements set by your lender. These typically include:

Sufficient Equity: Lenders usually allow a maximum loan-to-value (LTV) ratio, commonly 75% to 80% of your property’s market value.

Good Repayment History: Lenders will review your repayment track record on your existing mortgage.

Adequate Income: Your income and financial stability are critical factors. Lenders assess whether you can manage the additional debt without financial strain.

Credit Score: A good credit score demonstrates your creditworthiness and makes it easier to qualify for a top-up loan.

Learn more about eligibility criteria on Loanz360, your trusted financial guide.

Steps to Apply for a Mortgage Top-Up

Check Your Eligibility: Review your lender’s criteria to confirm you meet the requirements for a top-up loan.

Property Valuation: Your lender may require a property valuation to assess the current market value and available equity.

Submit an Application: Provide the necessary documentation, such as income proof, bank statements, and existing loan details.

Approval and Disbursement: Once approved, the lender will disburse the additional funds, which are typically added to your mortgage account.

Things to Consider Before Opting for a Mortgage Top-Up

Increased Financial Obligation: A top-up loan increases your overall debt and monthly repayment amount. Ensure you can manage the higher payments without compromising your financial stability.

Loan Tenure: Top-up loans are often linked to the remaining tenure of your existing mortgage. If your mortgage has a shorter term left, your EMIs (Equated Monthly Installments) for the top-up loan could be higher.

Interest Rates: While mortgage rates are typically lower than other forms of credit, ensure you compare the top-up rates offered by different lenders.

Prepayment Charges: Check whether prepayment charges apply if you plan to pay off your top-up loan early.

Purpose of Funds: Use the additional funds wisely. Avoid using them for non-essential expenses that don’t add long-term value.

Alternatives to Mortgage Top-Up Loans

If a top-up loan doesn’t seem like the right fit, consider these alternatives:

Home Equity Loan: This is a separate loan secured against the equity in your property.

Credit Line or Overdraft: A home equity line of credit (HELOC) or an overdraft facility offers flexible access to funds, allowing you to borrow as needed within a pre-approved limit.

Final Thoughts

A mortgage top-up can be a practical and cost-effective way to meet your financial needs. However, it’s essential to weigh the benefits and risks carefully before proceeding. Ensure you have a clear understanding of the terms and conditions, and only borrow what you can comfortably repay.

By making an informed decision, you can leverage your home’s equity to achieve your financial goals without jeopardizing your long-term stability. If you’re considering a mortgage top-up, consult with your lender or a financial advisor to explore your options and find the best solution tailored to your needs.

For the more details about mortigage loan, follow us on

0 notes

Text

Managing Debt Effectively: Your Guide to Financial Freedom

Debt is a common part of life, but managing it effectively is crucial for achieving long-term financial stability. Whether it’s student loans, credit card debt, mortgages, or personal loans, high levels of debt can quickly become overwhelming. The good news is that with the right strategies, you can take control of your debt and work toward a debt-free future.

Here’s how to manage debt effectively and regain financial freedom.

Step 1: Understand Your Debt

The first step in managing debt is knowing exactly what you owe. This means making a comprehensive list of all your debts, including:

Credit cards

Student loans

Car loans

Personal loans

Mortgage or rent

For each debt, write down:

The total balance

The interest rate

The minimum payment

By understanding your debt, you can prioritize which loans to pay off first and develop a strategy that works best for your financial situation.

Step 2: Create a Budget

A budget is essential when it comes to managing debt. It helps you track where your money is going and allows you to allocate funds toward paying off debt.

To create a budget:

List all sources of income (salary, side gigs, etc.).

Track all monthly expenses, including essential costs (e.g., utilities, groceries, housing) and non-essential costs (e.g., entertainment, dining out).

Determine how much you can afford to put toward debt each month, after covering your necessary expenses.

Tip: If you find that your income is lower than your expenses, consider cutting back on discretionary spending or finding ways to increase your income through side jobs or freelancing.

Step 3: Prioritize Debt Repayment

Not all debts are created equal, and prioritizing which debts to pay off first can save you money in interest over time. There are two common methods for prioritizing debt repayment:

The Debt Avalanche Method: In this approach, you focus on paying off the debt with the highest interest rate first, while making minimum payments on the others. This method saves the most money in interest over the long term.

The Debt Snowball Method: This method focuses on paying off the smallest debt first, regardless of the interest rate. Once the smallest debt is paid off, you move to the next smallest, and so on. While this method may not save as much in interest, it provides psychological wins as you pay off each debt, which can keep you motivated.

Step 4: Negotiate Lower Interest Rates

High interest rates can make it harder to pay off debt, so consider reaching out to creditors to negotiate lower rates. Many credit card companies, banks, or lenders are willing to work with you, especially if you have a good payment history. A lower interest rate means more of your payment goes toward the principal balance, which helps you pay off debt faster.

Additionally, if you have multiple credit cards, consider transferring balances to a card with a 0% introductory APR. Just be sure to pay off the balance within the introductory period to avoid interest charges.

Step 5: Consider Debt Consolidation

If managing multiple debts becomes overwhelming, you might consider debt consolidation. Debt consolidation involves combining several debts into one loan with a single monthly payment. This can simplify your repayment process and often result in a lower interest rate.

Options for consolidation include:

Personal loans from a bank or credit union

Balance transfer credit cards

Home equity loans or lines of credit (if you own a home)

Be cautious with debt consolidation, though, as it’s important not to accumulate new debt while paying off the consolidated loan.

Step 6: Avoid Accumulating More Debt

One of the most important steps in managing debt is avoiding the temptation to take on more debt while you’re trying to pay off existing balances. To do this:

Stop using credit cards (unless they offer significant rewards you can pay off each month).

Avoid taking out new loans unless absolutely necessary.

Build an emergency fund so you don’t rely on credit for unexpected expenses.

Step 7: Build Good Credit Habits

As you work to pay down debt, it’s essential to build healthy credit habits that will help you maintain financial stability in the future. Here are a few tips:

Pay bills on time: Late payments can result in fees and damage your credit score.

Keep credit card balances low: Ideally, keep your credit utilization ratio (the percentage of your credit limit that you’re using) below 30%.

Monitor your credit score: Regularly checking your credit score helps you track your progress and spot potential issues before they become major problems.

Step 8: Seek Professional Help If Needed

If you’re feeling overwhelmed by your debt, it may be helpful to seek guidance from a financial advisor or a credit counseling service. These professionals can help you:

Create a debt management plan

Negotiate with creditors

Provide budgeting and financial education

Many nonprofit credit counseling agencies offer free or low-cost services to help people manage their debt and improve their financial situation. KVR?

Conclusion:

Managing debt effectively is about creating a clear plan, sticking to your goals, and making consistent progress. While it may take time, the effort you put into paying down debt will pay off in the form of greater financial freedom and peace of mind.

Start by understanding your debt, creating a realistic budget, and using a repayment strategy that works for you. Remember, the road to financial freedom is a marathon, not a sprint, but every payment you make brings you one step closer to a debt-free life. Stay disciplined, avoid taking on more debt, and soon you’ll find yourself in a much stronger financial position.

#DebtFreeJourney#FinancialFreedom#ManageDebtSmart#BudgetingTips#DebtManagement#MoneyMatters#FinanceGoals#PersonalFinance#PayOffDebt#SmartMoneyMoves

1 note

·

View note

Text

Tips for Successful Investing in Rental Properties in Jamaica

As the real estate market in Jamaica continues to thrive, with homes for sale in Jamaica and Jamaica houses attracting investors from near and far, the opportunity to build wealth through rental property investments has never been more enticing. Whether you're eyeing a cozy studio apartment or a sprawling beachfront villa in one of Jamaica's vibrant communities, investing in Jamaica real estate can be a savvy financial move - but it's not without its challenges.

At 21st Century Real Estate, we've helped countless clients navigate the ins and outs of becoming successful Jamaica real estate investors. From finding the perfect Silverbrook Apartments or homes for sale in Jamaica to maximizing your rental income and managing tenants, we've compiled our top tips to set you up for success in the world of Jamaican rental property investment.

Location, Location, Location

When it comes to rental property investments, location is arguably the most important factor to consider. Look for neighborhoods in high-demand areas with low vacancy rates, good schools, and easy access to amenities like shopping, dining, and public transportation. In Jamaica, popular areas like Montego Bay, Negril, and Ocho Rios are always in high demand for both long-term rentals and short-term vacation rentals.

Do Your Due Diligence

Before purchasing any Jamaica houses or homes for sale in Jamaica, it's crucial to do your homework. Research average rental rates, occupancy rates, and operating expenses for similar properties in the area. Hiring a professional inspector to assess the condition of the home can also help you avoid costly surprises down the line. Don't forget to factor in additional costs like property management fees, insurance, and potential renovations or upgrades.

Crunch the Numbers

Once you've identified a promising property, it's time to run the numbers. Determine your projected rental income, operating expenses, and expected cash flow to ensure the investment aligns with your financial goals. A good rule of thumb is to aim for a property that will generate a monthly cash flow of at least 1% of the purchase price. This will help you cover your mortgage, taxes, insurance, and other costs while leaving room for a healthy profit.

Leverage Your Equity

If you already own a home in Jamaica or elsewhere, you may be able to use the equity in that property to finance the purchase of a rental property. This can be an effective way to grow your real estate portfolio without having to come up with a large down payment upfront. Just be sure to carefully consider the risks and speak with a financial advisor before tapping into your home equity.

Build a Reliable Team

Successful rental property investors know that they can't do it all alone. Surround yourself with a team of trusted professionals, including a knowledgeable real estate agent, a skilled property manager, a reliable contractor, and a savvy accountant. These experts can help you navigate the complexities of property acquisition, tenant management, maintenance, and tax planning.

Embrace Technology

In the 21st century, technology has revolutionized the way we manage rental properties. From online listing platforms and virtual tours to automated rent collection and maintenance tracking, there are countless tools and apps that can streamline your operations and save you time and money. Embrace these technological advancements to maximize the efficiency of your rental properties.

Screen Tenants Thoroughly

One of the most critical aspects of rental property investment is finding and retaining high-quality tenants. Take the time to thoroughly screen applicants, checking their credit history, employment status, and references. This can help you avoid the headaches of late payments, property damage, and evictions down the line.

Maintain the Property

Keeping your rental properties in top condition is essential for attracting and retaining tenants, as well as preserving the value of your investment. Develop a proactive maintenance plan and budget for regular upgrades and repairs. By staying on top of property maintenance, you can minimize costly issues and ensure your tenants are happy and comfortable.

Be Prepared for the Unexpected

Even the most carefully planned rental property investments can encounter unexpected challenges, from natural disasters to tenant disputes. Build up a financial cushion to cover vacancies, repairs, and other unforeseen expenses. Additionally, ensure you have the appropriate insurance coverage in place to protect your investment and your tenants.

Stay Informed and Adaptable

The real estate market is constantly evolving, and successful rental property investors know how to adapt to changing conditions. Stay informed about market trends, new legislation, and industry best practices. Be willing to adjust your strategies as needed to maximize your returns and ensure the long-term viability of your investments.

By following these tips and leveraging the expertise of the 21st Century Real Estate team, you can navigate the world of rental property investment in Jamaica with confidence. Whether you're looking to add a cozy Silverbrook Apartments unit to your portfolio or a sprawling beachfront villa, the opportunities for building wealth through Jamaican real estate are abundant. So why wait? Start your journey to becoming a successful rental property investor today.

#house for sale in jamaica#jamaica houses#houses for sale in jamaica#jamaica real estate#homes for sale jamaica#21st century real estate#silverbrook apartments

0 notes

Text

Financing Options for Building an Accessory Dwelling Unit (ADU)

Are you considering building an ADU but wondering how to finance it? Tiny Homes of Iowa has you covered! As Iowa’s leading builder of stick-built ADUs, we’re dedicated to providing flexible financing solutions that meet our clients’ needs. In this guide, we’ll walk you through various financing options to make your ADU dream a reality.

Financing Options to Consider:

HELOC Loans

A Home Equity Line of Credit (HELOC) is one of the most popular choices among homeowners. By tapping into the equity in your primary residence, a HELOC provides an affordable way to fund your Accessory dwelling unit plans. This option often offers more manageable payments than alternatives, like renting out your ADU or covering assisted living costs for family members.

Construction Bridge Loans

For those needing a boost in available funds, a Bridge Loan could be the answer. This loan provides upfront financing for your ADU project, and once construction is complete, it can be repaid through a HELOC or cash-out refinance, based on the increased property value.

Cash-Out Refinance

Ready for a financial reset? A cash-out refinance allows you to leverage your home’s equity by replacing your current mortgage and using the difference to finance your ADU plans. This option is ideal if you have significant home equity and are currently dealing with a high mortgage rate.

Standard Construction Loan

If you prefer not to use your home’s equity, a construction loan may be a good alternative. Though it requires stricter credit and income criteria, this option enables you to finance your ADU project independently of your home’s equity, providing a flexible approach for many homeowners.

Ready to Begin Your ADU Financing Journey?

The sooner you start, the sooner you can enjoy your new ADU! Our team of experts is here to guide you every step of the way, from property assessment to accurate cost estimates. Contact us today to schedule a complimentary consultation, and let’s bring your ADU vision to life!

0 notes

Text

Exploring Financing Options for Window Replacement in Jacksonville, AL

Investing in new windows for your home in Jacksonville, AL, can significantly enhance energy efficiency, curb appeal, and overall comfort. However, the upfront cost of window replacement can be a significant financial commitment. Fortunately, various financing options are available to help homeowners manage this investment. At Vinyl Window Solutions, we understand the importance of finding the right financing solution that fits your budget and needs. In this article, we will explore the financing options available for window replacement in Jacksonville, AL, and provide tips for making an informed decision.

1. Understanding the Costs of Window Replacement

Before diving into financing options, it's essential to understand the costs associated with window replacement in Jacksonville, AL. Factors that influence the cost include:

Type of Windows: Different window styles, such as double-hung, casement, or sliding windows, come with varying price points. Energy-efficient options or specialty windows may also be more expensive.

Materials: Window frames can be made from vinyl, wood, aluminum, or fiberglass, each with different costs and benefits.

Installation: The complexity of the installation can affect labor costs. Installing replacement windows may require additional structural work or adjustments to the existing frame.

Number of Windows: The total cost will increase with the number of windows you choose to replace.

By understanding these factors, you can better assess the overall investment required for your window replacement project.

2. Cash Payment

If you have the financial resources, paying for your window replacement project in cash is the simplest option. Here are some benefits and considerations:

Benefits

No Interest or Fees: Paying upfront eliminates the need to pay interest or financing fees associated with loans or credit cards.

Ownership: You own the windows outright once they are paid for, providing peace of mind and avoiding future payments.

Considerations

Impact on Savings: Paying cash may deplete your savings or emergency funds, so consider whether you can comfortably afford this option without compromising your financial security.

3. Personal Loans

A personal loan can be a viable option for financing your window replacement project. Here’s how it works:

What is a Personal Loan?

A personal loan is a type of unsecured loan that allows you to borrow a specific amount of money to be paid back over a set period with fixed monthly payments.

Benefits

Fixed Payments: With a personal loan, you’ll know exactly how much you need to pay each month, making budgeting easier.

Flexible Use: You can use the funds for various expenses, including window replacement.

Considerations

Interest Rates: Personal loan interest rates can vary significantly based on your credit score and financial history. Shop around for the best rates.

Loan Terms: Look for a loan term that fits your financial situation. Shorter terms may mean higher monthly payments, while longer terms could lead to paying more interest over time.

4. Home Equity Loans and Lines of Credit

If you have built up equity in your home, a home equity loan or line of credit (HELOC) can be an excellent option for financing your window replacement.

What is a Home Equity Loan?

A home equity loan allows you to borrow against the equity you’ve built in your home. You receive a lump sum upfront and repay it over a fixed term with a fixed interest rate.

What is a HELOC?

A home equity line of credit works like a credit card, allowing you to borrow against your home equity as needed. You can withdraw funds during a draw period and only pay interest on the amount borrowed.

Benefits

Lower Interest Rates: Home equity loans and HELOCs typically offer lower interest rates than personal loans because they are secured by your home.

Tax Benefits: Interest paid on home equity loans may be tax-deductible, depending on your financial situation and how you use the funds. Consult a tax professional for advice.

Considerations

Risk of Foreclosure: Since your home secures these loans, failure to repay can result in foreclosure.

Closing Costs: Home equity loans may have closing costs, which can add to your overall expenses.

5. Credit Cards

Using a credit card for window replacement in Jacksonville, AL can be an option, especially for smaller projects. Here’s what you should know:

Benefits

Immediate Access to Funds: If you already have a credit card with available credit, you can access funds immediately.

Rewards and Benefits: Some credit cards offer rewards, cashback, or other perks for using them, which can add value to your purchase.

Considerations

High-Interest Rates: Credit cards typically have higher interest rates than other financing options. If you can’t pay off the balance quickly, you could end up paying significantly more in interest.

Credit Utilization: High balances on credit cards can negatively impact your credit score.

6. Manufacturer or Contractor Financing

Many window manufacturers and contractors, including Vinyl Window Solutions, offer financing options directly to customers. Here’s what to consider:

Benefits

Convenient Application Process: Financing through the contractor can simplify the application process, often allowing you to complete everything in one place.

Promotional Offers: Some manufacturers may offer promotional financing with low or zero interest for a specific period.

Considerations

Read the Fine Print: Be sure to understand the terms and conditions of the financing offer, including interest rates and repayment terms.

Limited Choices: Financing options through manufacturers may not be as flexible as personal loans or HELOCs.

7. Government and Energy Efficiency Programs

In some cases, government programs and incentives may be available to help homeowners finance energy-efficient home improvements, including window replacement. Check for:

Local Incentives

Rebates and Grants: Some local governments may offer rebates or grants for energy-efficient window replacements. Research available programs in Jacksonville, AL.

Federal Tax Credits

Energy-Efficient Upgrades: The federal government may offer tax credits for energy-efficient home improvements, including windows. Be sure to consult a tax professional to understand how these credits can apply to your project.

8. Tips for Choosing the Right Financing Option

When exploring financing options for your window replacement in Jacksonville, AL, consider the following tips:

Evaluate Your Budget

Determine how much you can comfortably afford to pay each month. This will help you narrow down your financing options.

Shop Around

Don’t settle for the first financing option you find. Compare interest rates, terms, and fees from various lenders and contractors.

Consider Your Credit Score

Your credit score can significantly impact the interest rates and terms you qualify for. Check your credit report and consider improving your score if necessary before applying for financing.

Read the Fine Print

Always read the terms and conditions of any financing offer carefully. Look for hidden fees, penalties, and other important details that could affect your decision.

Conclusion

Financing your window replacement in Jacksonville, AL, doesn’t have to be overwhelming. By understanding the various financing options available and evaluating your budget and needs, you can make an informed decision that works best for you. At Vinyl Window Solutions, we’re here to help you navigate the financing process and answer any questions you may have about your window replacement project. Contact us today to learn more about our financing options and start transforming your home with new windows!

0 notes

Text

The Benefits of Using Your Equity To Make a Bigger Down Payment

Did you know? Homeowners are often able to put more money down when they buy their next home. That’s because, once they sell, they can use the equity they have in their current house toward their next down payment. And it’s why as home equity reaches a new height, the median down payment has too.

According to the latest data from Redfin, the typical down payment for U.S. homebuyers is $67,500—that’s nearly 15% more than last year, and the highest on record (see graph below):

Here’s why equity makes this possible. Over the past five years, home prices have increased significantly, which has led to a big boost in equity for current homeowners like you. When you sell your house and move, you can take the equity that gives you and apply it toward a larger down payment on your new home. That’s a major opportunity, especially if you’ve had concerns about affordability.

Now, it’s important to remember you don’t have to make a big down payment to buy your next home—there are loan programs that let you put as little as 3%, or even 0% down. But there’s a reason so many current homeowners are opting to put more money down. That’s because it comes with some serious perks.

Why a Bigger Down Payment Can Be a Game Changer

1. You’ll Borrow Less and Save More in the Long Run

When you use your equity to make a bigger down payment on your next home, you won’t have to borrow as much. And the less you borrow, the less you’ll pay in interest over the life of your loan. That’s money saved in your pocket for years to come.

2. You Could Get a Lower Mortgage Rate

Providing a larger down payment shows your lender you’re more financially stable and not a large credit risk. The more confident your lender is in your credit score and your ability to pay your loan, the lower the mortgage rate they’ll likely be willing to give you. And that amplifies your savings.

3. Your Monthly Payments Could Be Lower

A bigger down payment doesn’t just help you reduce how much you have to borrow—it also means your monthly mortgage payment may be smaller. That can make your next home more affordable and give you a bit more breathing room in your budget.

4. You Can Skip Private Mortgage Insurance (PMI)

If you can put down 20% or more, you can avoid Private Mortgage Insurance (PMI), which is an added cost many buyers have to pay if their down payment isn’t as large. Freddie Mac explains it like this:

“For homeowners who put less than 20% down, Private Mortgage Insurance or PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. It is not the same thing as homeowner's insurance. It's a monthly fee, rolled into your mortgage payment, that’s required if you make a down payment less than 20%.”

Avoiding PMI means you’ll have one less expense to worry about each month, which is a nice bonus.

Bottom Line

Down payments are at a record high, largely because recent equity gains are putting homeowners in a position to put more money down.

If you’re thinking about selling your current house and moving, let’s work together to figure out how much home equity you have right now, and how it can boost your buying power in today’s market.

0 notes

Text

Unlocking The Potential Of Your Property: A Guide To ADU Construction In Knoxville

Knoxville is a city teeming with potential, and your property might be the next ample opportunity. Have you ever considered how an Accessory Dwelling Unit (ADU) could unlock that hidden value? Whether you want to create extra income, accommodate family members, or enhance your living space, ADU construction in Knoxville is gaining traction among homeowners. This guide will walk you through everything from design tips to financing options, helping you transform your property into a multifaceted asset that meets modern needs. Let's delve into the exciting world of ADUs and discover how they can elevate your lifestyle while boosting your property's worth. ADU Construction Knoxville

The Benefits of Building an ADU in Knoxville

Building an ADU in Knoxville opens doors to numerous advantages. First, it provides a fantastic opportunity for rental income. With the local housing market thriving, homeowners can capitalize on this demand and enjoy additional cash flow.

Beyond financial benefits, ADUs create flexible living arrangements. They're perfect for accommodating aging parents or adult children seeking independence while remaining close by.

Another perk is increased property value. An attractive ADU can significantly enhance your home's overall worth, making it appealing to future buyers.

Sustainability also plays a role in the appeal of ADUs. These smaller structures often use fewer resources and energy than traditional homes, aligning with eco-friendly trends that many residents embrace.

Building an ADU allows homeowners to maximize their lot space creatively. It offers endless possibilities for personalized designs tailored to unique lifestyles and needs in vibrant Knoxville neighborhoods.

Tips for Designing Your ADU

When designing your ADU, first consider functionality. Consider how the space will be used daily. A well-planned layout maximizes efficiency and comfort.

Natural light can make a significant difference. Large windows or skylights brighten the interior and create an open feel, making your ADU more inviting.

I am trying to remember storage solutions. Built-in shelves or multi-purpose furniture can keep things organized without sacrificing style.

Choose materials that reflect both durability and aesthetics. High-quality finishes can enhance longevity while maintaining charm.

Consider energy efficiency in your design choices. Incorporating sustainable elements like solar panels or efficient insulation lowers long-term costs and minimizes environmental impact.

The Construction Process and Timeline

The construction of an ADU in Knoxville is an exciting journey. It typically starts with obtaining the necessary permits and approvals. This phase can take several weeks, so be prepared.

Once permits are secured, excavation and foundation work begin. Depending on your design, this could span a few weeks to a month.

Framing follows closely behind, where walls and roofing join to form the structure. This part usually takes two to three weeks.

The next step is to install plumbing, electrical systems, and insulation—crucial steps that ensure comfort and livability.

It's time for interior finishes like flooring, cabinetry, and paint. Depending on complexity and local conditions, the overall timing for complete ADU construction can range from four months to over six months.

Each step requires attention to detail to bring your vision into reality.

Financing Options for ADUs in Knoxville

Understanding your financing options is crucial when considering ADU construction in Knoxville. Homeowners have several pathways to explore.

One popular choice is a home equity line of credit (HELOC). This allows you to tap into your existing home's value. It provides flexibility and often lower interest rates compared to other loans.

Another option is a cash-out refinance. By refinancing your mortgage, you can access funds for building an ADU while potentially lowering your monthly payments.

Local banks and credit unions may offer specific loans tailored for accessory dwelling units. These institutions can provide personalized advice based on Knoxville's real estate market.

Pay attention to government programs, too. Some federal or state initiatives support homeowners looking to build ADUs, offering grants or low-interest loans to ease financial burdens during construction.

Understanding these diverse financing avenues will empower you as you embark on your ADU journey in Knoxville.

Conclusion

Building an Accessory Dwelling Unit (ADU) can significantly enhance your property value and versatility in Knoxville. The benefits are substantial, whether you want to generate rental income, accommodate family members, or create a personal retreat.

Planning your ADU thoughtfully ensures it complements your existing home while meeting local regulations. Engaging with professionals during the design phase can lead to innovative ideas that maximize space and functionality.

Understanding the construction process helps you set realistic timelines and expectations. Knowing what's involved at each stage will reduce stress and help keep your project on track.

Financing options for ADUs are diverse, providing multiple pathways to fund this investment. Exploring various financing solutions makes finding one that suits your financial situation easier.

By tapping into all these facets of ADU construction in Knoxville, you unlock not only the potential of your property but also open doors for future opportunities. Each step is a chance to enhance both living spaces and lifestyle possibilities.

0 notes

Video

youtube

With inflation cooling, the Federal Reserve announced on September 18, 2024, that it would cut interest rates by a whopping half a percentage point. It is a big relief for many Americans, including college students, entrepreneurs, and prospective homebuyers, who have been waiting for the right time to take out a loan.What is the reason? Supply remains low. As interest rates decrease, an increasing number of purchasers will surely join the market. This may imply that there may be a substantial increase in rivalry for limited inventories shortly. A bidding war for a limited number of desirable houses for sale may once again become commonplace, resulting in increased prices. Taking action right now circumvents that very real possibility.The “Best Time to Buy” May Never Come Some potential purchasers hesitated not because they were unprepared to make an offer but because they were sitting on the fence for a while in anticipation of the Federal Reserve's actions and the market's potential trajectory. Many people believed that the Federal Reserve was waiting too long to make the recent move, and the anticipation of rate decreases did not even start to become apparent this year. Anybody looking to purchase a house as an investment might have waited for this moment to strike, and now it has.Price fluctuations are nothing new in the real estate industry, as seen over the last few years. Nonetheless, real estate values often appreciate with time.In other words, the future worth of a home often exceeds its current value. For some people, a house is an investment with the hope of reaping a profit when the time comes to sell. In the eyes of some savvy buyers, the benefit of owning a house is that, unlike other assets, you can live in it every day, saving on rent and building equity in it over time!The percentage of the principal amount that you have paid off determines your equity in a home. What is the significance of building equity? Firstly, you can liquidate it if necessary, either by selling your property or by establishing a Home Equity Line of Credit (HELOC). Instead of going to a landlord, your payments accumulate until you own your property completely. Each month you postpone purchasing a house, you forfeit the chance to accumulate equity in your ideal residence; hence, some individuals may see no need to delay further after FED's first significant rate reductions.Both equity and increasing house prices are advantages that need time to develop. Delaying a purchase incurs opportunity costs that escalate with each postponement. No one knows when the "optimal moment to purchase" will come. Many purchasers comprehend that we only know the current state of the market; we have no idea how it will change over time, and this is reason enough to see an influx of buyers in the market. It is impossible to precisely estimate when rates will decline or the extent of their decrease. We only know the current state of the market; we have no idea how it will change over time, which is a reason enough to see an influx of buyers in the market.Full Article: https://www.burrowes.com/blog/santa-cruz-homes-for-sale-fed-cuts-could-open-doors-for-home-buyers/

0 notes

Text

The First 5 Things You Should Do When Remodeling Your House: A Step-by-Step Guide

Remodeling your home is a major undertaking that requires thoughtful planning, organization, and execution. Whether you’re tackling a single room or the entire house, the process can be daunting without a clear strategy. To help you avoid common pitfalls and ensure a smooth renovation, here are the first five critical steps to follow when remodeling your house.

1. Assess Your Needs and Goals

The first step in any home remodel is to define your goals clearly. What exactly do you want to achieve? Are you looking to increase space, improve functionality, or simply update the aesthetics? Understanding the scope of your renovation is essential for both your planning and budgeting.

Make a list of priorities. If you're remodeling multiple areas of your home, such as the kitchen, bathroom, and living room, determine which space is the most critical. This will allow you to focus your efforts and resources effectively, ensuring that the most urgent needs are addressed first. For instance, if your kitchen is outdated and doesn’t meet modern standards, it might be a good idea to start there.

Additionally, consider long-term goals. If you plan to stay in the home for many years, make decisions that will enhance your living experience for years to come. On the other hand, if you're remodeling to sell, prioritize updates that increase your home's market value on setting renovation goals or planning a kitchen remodel.

2. Set a Realistic Budget

Once you've outlined your goals, it's time to establish a budget. A well-defined budget will serve as your financial roadmap throughout the remodeling process. Begin by researching the average cost of similar renovation projects in your area. Be sure to include the cost of materials, labor, permits, and any potential unforeseen expenses that may arise along the way.

A common mistake is to underestimate the cost of the remodel. Leave room for contingencies, as unexpected challenges can easily add 10-20% to your original budget. Think about how you will finance the project, whether it’s through savings, a loan, or a home equity line of credit.

If you’re looking for ways to make the most of your budget, check out our guide to budget-friendly home renovations.

3. Hire the Right Contractors

Choosing the right contractor is crucial to the success of your remodeling project. A reliable and experienced contractor can help turn your vision into reality while avoiding costly mistakes. Start by getting recommendations from friends, family, or neighbors who have recently remodeled their homes. Online reviews and ratings are also useful resources for identifying reputable professionals in your area.

When interviewing potential contractors, be sure to ask for references and review their portfolios to see examples of their past work. Verify that they are licensed, insured, and experienced in the type of renovation you’re planning. Discuss your expectations upfront and ensure that the contractor understands your budget, timeline, and design preferences or choosing the right contractor..

4. Obtain Permits and Approvals

Before any work begins, it's essential to secure the necessary permits for your project. Most major renovations—especially those involving structural changes, electrical work, or plumbing—require permits from your local government. Building codes are in place to ensure that all work is safe and up to standard, so failing to get the proper permits can result in fines, delays, or even having to redo parts of the project.

Your contractor should be familiar with the permit process and can often handle this on your behalf. However, it's important to stay informed and ensure that everything is in order before construction starts.

For a deeper dive into the permitting process and how it impacts your remodel, visit our guide on navigating permits.

5. Design and Plan the Layout

Once you’ve secured your permits and chosen your contractor, it’s time to focus on the design and layout of your remodel. Whether you’re working with a professional designer or doing it yourself, make sure that the layout is both functional and aesthetically pleasing. In addition to looking good, your remodeled space should meet your practical needs.

For instance, if you’re remodeling a kitchen, think about the flow of movement—placing the sink, refrigerator, and stove in close proximity can increase efficiency. If you’re renovating your bathroom, consider storage solutions that maximize the space available.

During this phase, it's important to finalize all material choices, from flooring and cabinetry to paint colors and fixtures. This will allow your contractor to stay on schedule and avoid delays caused by last-minute decisions.

In summary, remodeling your home doesn’t have to be overwhelming if you follow these five essential steps. By carefully assessing your needs, setting a budget, hiring the right professionals, obtaining permits, and planning your layout, you can ensure a smooth and successful renovation experience. If you're ready to dive deeper into more specific remodeling topics, such as maximizing small spaces or choosing the best materials.

0 notes

Text

Reverse Mortgages Explained: How They Work in 2024

As we age, many of us find ourselves with a valuable home but not enough cash to cover everyday expenses. A reverse mortgage can help. It allows homeowners, usually 62 or older, to tap into their home’s value without selling it.

What Is a Reverse Mortgage?

A reverse mortgage is a type of loan. Instead of making payments to a lender like with a regular mortgage, the lender pays you. You can get the money in different ways: a lump sum, monthly payments, or as a line of credit to use when you need it. The loan doesn't need to be paid back until you sell the home, move out, or pass away.

How Does a Reverse Mortgage Work in 2024?

In 2024, reverse mortgages still have some basic rules:

Age Requirement: You need to be 62 or older.

Home Ownership: You must own your home or have a lot of equity in it.

Primary Residence: The home has to be where you live most of the time.

Here’s how the process works step by step:

Counseling: You’ll first meet with a housing counselor who will explain the details, including costs and benefits, to make sure you understand everything. This step is required.

Application: After counseling, you can apply for the reverse mortgage with a lender.

Home Appraisal: Your home’s value will be checked through an appraisal. The more your home is worth and the older you are, the more money you may be able to borrow.

Getting Your Money: Once approved, you can choose how to receive the money. In 2024, the most common reverse mortgage is called a Home Equity Conversion Mortgage (HECM), which is insured by the government.

Repayment: You don’t make payments during the loan. It only needs to be repaid when you sell your home, move out permanently, or pass away. When that happens, the home is typically sold, and the money from the sale goes toward paying off the loan. If there’s extra money, it goes to you or your heirs. If the home is worth less than the loan, insurance will cover the difference, so your heirs won’t owe anything.

Pros and Cons of a Reverse Mortgage

Pros:

You get extra money without selling your home.

You don’t have to make monthly mortgage payments.

You stay in your home as long as you like.

Cons:

Interest builds up over time, which reduces the amount of money you (or your heirs) may get when the home is sold.

It might affect your eligibility for benefits like Medicaid.

It reduces the equity in your home, leaving less for your heirs.

Is a Reverse Mortgage Right for You?

Reverse mortgages can be helpful for older adults who plan to stay in their homes and need extra cash for living expenses or to pay off an existing mortgage. However, they come with costs and can eat up the equity in your home. Before deciding, it’s a good idea to talk to a financial advisor to make sure it’s the right choice for your situation.

Final Thoughts

In 2024, reverse mortgages remain a useful option for retirees needing extra cash. They allow you to access the value of your home without selling it, providing financial relief while you continue to live in your house. Just make sure to weigh the pros and cons carefully and seek expert advice to make an informed decision.

0 notes

Photo

Exploring Financing Options for Boat Purchases in Jacksonville

If you're considering purchasing a boat in Jacksonville, one crucial step is to hire yacht surveyors Jacksonville. These professionals play a vital role in ensuring that your investment is sound and secure. With the expertise of marine surveyors in Jacksonville Florida, you can confidently navigate the waters of boat financing options. One of the first steps in the boat-buying process is to determine your budget. Understanding how much you can afford will help narrow down your options when it comes to selecting a vessel. Once you have a clear idea of your budget, it's time to start exploring financing options for your boat purchase. There are several ways to finance a boat purchase in Jacksonville. One option is to secure a loan through a financial institution. Banks and credit unions often offer competitive rates for boat loans, making them a popular choice among buyers. Another option is to explore financing options through boat dealerships. Many dealerships offer in-house financing programs that cater to the needs of boat buyers. In addition to traditional financing options, there are also alternative methods for financing a boat purchase. Some buyers choose to use a home equity line of credit (HELOC) or personal loan to fund their purchase. While these options may come with their own set of risks, they provide flexibility and convenience for buyers who may not qualify for traditional boat loans. When it comes to financing a boat purchase in Jacksonville, working with experienced yacht surveyors Jacksonville is essential. These professionals can help you understand the true value of the vessel you are considering and ensure that you are making a wise investment. By partnering with Sun Coast Marine Surveying & Consulting, you can rest assured that you are in good hands. Sun Coast Marine Surveying & Consulting is a trusted name in the industry, known for their thorough and comprehensive marine surveys. With their expertise, you can make informed decisions about your boat purchase and secure the financing you need to sail away with confidence. Whether you are buying a new or used boat, having a marine survey conducted by experts like those at Sun Coast Marine Surveying & Consulting is crucial. Their detailed reports will give you peace of mind knowing that your investment is protected. In conclusion, when it comes to financing a boat purchase in Jacksonville, it's essential to work with reputable yacht surveyors Jacksonville. By partnering with Sun Coast Marine Surveying & Consulting and utilizing the expertise of marine surveyors in Jacksonville Florida, you can make informed decisions about your purchase and navigate the waters of boat financing with confidence. Don't let the complexities of boat financing overwhelm you - enlist the help of professionals to guide you every step of the way.

yacht surveyors jacksonville

0 notes

Link

#AAG#AAGReverseMortgage#AAGReverseMortgageCompany#fhareversemortgage#hecmreversemortgage#howdoesareversemortgagework#mortgage#reversemortgage#reversemortgageexplained#reversemortgageexplainedsimply#reversemortgagefacts#reversemortgageinformation#reversemortgagelineofcredit#reversemortgageloan#reversemortgageprosandcons#reversemortgageyoutube#reversemortgages#tomselleckreversemortgage#whatisareversemortgage

0 notes

Text

Home Equity Lines of Credit vs. Home Equity Loans: Which is Right for You?

When you’re looking to tap into the value of your home for extra funds, you generally have two main options: a Home Equity Line of Credit (HELOC) and a Home Equity Loan. Both can be useful, but they serve different needs. Let’s break down each option so you can make an informed decision.

What is a Home Equity Line of Credit (HELOC)?

A HELOC is like a credit card that uses your home’s equity as collateral. Here’s how it works:

Revolving Credit: You’re given a credit limit based on the equity you have in your home. You can borrow up to this limit, pay it back, and borrow again during the draw period (typically 5-10 years).

Variable Interest Rates: HELOCs usually come with variable interest rates, which means the rate can change over time. This can be a bit of a gamble if interest rates go up.

Flexible Access: You can draw money as needed, which is great for ongoing expenses or projects. You only pay interest on the amount you’ve borrowed, not the total credit limit.

Interest-Only Payments: During the draw period, you might only need to make interest payments. However, once the draw period ends, you'll start repaying both principal and interest.

What is a Home Equity Loan?

A Home Equity Loan is a lump sum loan that you repay in fixed installments. Here’s what you need to know:

Lump Sum Disbursement: You receive a one-time lump sum payment that you’ll use for whatever you need. This is ideal for a big purchase or a specific project.

Fixed Interest Rates: Most Home Equity Loans come with fixed interest rates, meaning your payment amount will stay the same throughout the life of the loan.

Predictable Payments: Since you have fixed monthly payments and a set term, budgeting can be easier. You know exactly how much you’ll pay each month and when the loan will be paid off.

Fixed Term: These loans usually have a set term (e.g., 5-15 years), after which the loan is fully repaid.

Which Option is Right for You?

Choosing between a HELOC and a Home Equity Loan depends on your needs and financial situation:

Consider a HELOC if:

You need flexibility and want to borrow as needed.

You’re okay with variable interest rates and can manage potential rate increases.

You have ongoing or uncertain expenses.

Consider a Home Equity Loan if:

You need a lump sum for a specific purpose, like a major renovation or debt consolidation.

You prefer the stability of fixed monthly payments and interest rates.

You can plan and budget for a consistent monthly payment.

Conclusion

Both HELOCs and Home Equity Loans have their benefits, depending on what you’re looking to achieve. Take a close look at your financial goals, how you plan to use the funds, and your comfort with fluctuating payments before making a decision. Whichever option you choose, make sure it aligns with your long-term financial strategy.

0 notes

Photo

Navigating the world of ADUs—Accessory Dwelling Units—can be as complex as it is exciting, especially in a burgeoning market like Port St. Lucie. This guide provides a thorough breakdown of everything from selecting the right ADU contractors to understanding the financial aspects of your project. https://speedyhomecontractor.com

Choosing the Right ADU Builder

Finding reliable accessory dwelling unit builders is your first step. In Port St. Lucie, seasoned ADU contractors have the expertise to ensure your addition is built to last and complies with local regulations. Opt for custom ADU builders who offer services like fast ADU room addition installation or affordable ADU garage conversions. Their experience can help avoid common pitfalls in the permitting and construction process.

Understanding the Costs

The cost of building an ADU in Port St. Lucie can vary widely. Factors include the complexity of the project, materials used, and whether you’re starting from scratch or converting an existing structure. On average, prices might range from $100,000 to over $300,000 for high-end custom builds. Getting quick ADU room addition quotes from local experts can give you a clearer starting point.

Financing Your ADU

Navigating ADU financing options is crucial. Whether it’s a construction loan for an ADU, a home equity line of credit, or more specialized adu construction loans, understanding how to finance an ADU will determine what is feasible for your budget. Here are some pointers:

ADU Loans: Some financial institutions now offer loans specifically designed for ADUs. These can be more flexible than traditional loans and tailored to the unique needs of building an ADU.

Construction Loans: A construction loan for an ADU is a short-term loan that covers just the building phase. Once construction is completed, the loan typically converts into a mortgage.

Government Programs and Grants: Occasionally, local or state governments may offer programs or grants to encourage ADU development, particularly if it increases affordable housing options.

Step-by-Step Guide to Building an ADU in Port St. Lucie Research and Planning: Understand local zoning laws and building codes. Decide on the type and size of ADU you want, considering how it will serve your needs.

Choosing a Builder: Select a contractor who specializes in ADUs and has a good reputation in the Port St. Lucie area. Look for someone who can handle permits, construction, and can advise on financing.

Design and Permits: Work with your contractor to design your ADU. They can help navigate the permitting process, which can be one of the more tedious steps in the process.

Construction: With a design and permits in hand, construction can begin. Depending on the scope, this could take anywhere from a few months for a simple conversion to over a year for more complex builds.

Inspection and Completion: Once construction is complete, your ADU will need to be inspected by local authorities to ensure it meets all codes and regulations before it can be occupied.

Final Thoughts

Building an ADU in Port St. Lucie is a significant investment that can provide returns both financially and in lifestyle enhancement. By understanding the process, costs, and financing options, you’ll be better equipped to make informed decisions and avoid common pitfalls.

For more insights and detailed discussions, or to get a quote from top Port St. Lucie ADU builders, visit our dedicated section on ADU projects. Let’s transform your property with a perfect ADU that suits your needs and budget.

Port St. Lucie ADU Builders

1860 SW Fountainview Blvd

Port St. Lucie, FL 34986

(772) 244-3349

https://adubuildersportstlucie.com

0 notes

Text

How to Improve Your Credit Score Before Refinancing Your Mortgage

Refinancing your mortgage can be a smart financial move, allowing you to secure a lower interest rate, reduce monthly payments, or access the equity in your home. However, one of the most critical factors in determining your eligibility for a refinance—and the terms you’ll receive—is your credit score. A higher credit score can mean lower interest rates and better loan terms, while a poor score may prevent you from refinancing at all.

If you’re considering refinancing but your credit score isn’t where you’d like it to be, don’t worry. With careful planning and effort, you can improve your credit score and increase your chances of securing favorable refinancing terms. Here’s how to do it.

1. Check Your Credit Report for Errors

The first step in improving your credit score is to review your credit report for errors. Credit reports can contain mistakes, such as incorrect account information, late payments that weren’t actually late, or accounts that don’t belong to you. These errors can significantly impact your credit score, so it’s essential to correct them.

You’re entitled to a free credit report from each of the major credit bureaus—Experian, Equifax, and TransUnion—once a year. Obtain your reports and review them carefully. If you spot any errors, dispute them with the credit bureau. Correcting inaccuracies can quickly boost your credit score.

2. Pay Down Outstanding Debt

One of the biggest factors affecting your credit score is your credit utilization ratio, which is the amount of revolving credit you’re using compared to your credit limit. A high credit utilization ratio can negatively impact your score, even if you make all your payments on time.

To improve your score before refinancing, focus on paying down outstanding credit card debt. Aim to keep your credit utilization ratio below 30%—meaning if you have a credit limit of $10,000, you should try to keep your balance under $3,000.

By reducing your credit card balances, you can lower your credit utilization and give your credit score a significant boost.

3. Make All Payments on Time

Your payment history is one of the most crucial factors in determining your credit score, accounting for 35% of your overall score. Late or missed payments can have a substantial negative impact, while consistent, on-time payments will improve your score over time.

If you’ve struggled with making timely payments in the past, it’s essential to get back on track before attempting to refinance your mortgage. Set up automatic payments or reminders to ensure you never miss a due date. Even a few months of consistent, on-time payments can help raise your credit score.

Additionally, if you have any past-due accounts, make arrangements to pay them off as soon as possible. While older late payments will eventually have less of an impact on your score, bringing your accounts current is a critical step in improving your credit.

4. Avoid Opening New Credit Accounts

While it might seem tempting to open new credit accounts to spread out your balances and lower your credit utilization ratio, this strategy can backfire in the short term. Each time you apply for credit, a hard inquiry is added to your credit report, which can slightly lower your score.

Opening multiple new accounts in a short period can signal to lenders that you’re in financial distress, which may negatively impact your creditworthiness. Instead, focus on managing your existing credit accounts responsibly and avoid opening new lines of credit unless absolutely necessary.

5. Don’t Close Old Credit Accounts

While paying off debt is important, closing old credit accounts isn’t always the best idea. Closing accounts can actually hurt your credit score, particularly if the account has been open for a long time. This is because your credit history length—the average age of your accounts—is another factor that impacts your credit score.

If you close a long-standing credit account, you may shorten the length of your credit history, which could lower your score. Instead of closing accounts, keep them open and use them occasionally to show lenders that you can responsibly manage credit over time.

6. Diversify Your Credit Mix

Your credit mix—the variety of credit accounts you have—makes up about 10% of your credit score. Lenders like to see a mix of different types of credit, such as credit cards, auto loans, student loans, and mortgages, as it demonstrates your ability to manage multiple forms of debt.

While you shouldn’t open new accounts just to diversify your credit mix, if you already have installment loans (like a car loan) and revolving credit (like credit cards), it’s a good idea to continue managing them responsibly. Doing so can positively impact your credit score over time.

7. Wait for Negative Marks to Age Off

If you have negative marks on your credit report, such as late payments, charge-offs, or collections, they will typically remain on your report for seven years. However, their impact on your score lessens over time.

If you’ve had past credit issues, one strategy is to wait for these negative marks to age off your report or become less significant. In the meantime, focus on building positive credit habits like making on-time payments and reducing your debt. As time passes, your score will likely improve.

8. Seek Professional Help if Needed

If your credit situation is particularly challenging, you may want to consider working with a credit counselor or financial advisor. These professionals can help you create a debt management plan, negotiate with creditors, and provide guidance on how to improve your credit score.

Be cautious when choosing a credit repair service, as some may charge high fees without delivering results. Look for a reputable organization that offers free or low-cost services and has a track record of helping clients improve their credit.

Conclusion

Improving your credit score before refinancing your mortgage is one of the best ways to secure more favorable loan terms, such as lower interest rates and monthly payments. By taking proactive steps like checking your credit report for errors, paying down debt, and making consistent on-time payments, you can boost your credit score and put yourself in a stronger financial position.

Remember that improving your credit score takes time, so start the process well in advance of your refinancing application. With patience and responsible credit management, you can achieve your goal of refinancing your mortgage and saving money in the long run.

Securing a mortgage refinancing may seem daunting, but by following these steps and working with the right lender, you can secure the funding needed to grow your business. Keep in mind that preparation and a solid financial foundation are key to getting approved for a commercial mortgages

0 notes